How Home Appliances Insurance can Save You Time, Stress, and Money.

Table of ContentsThe Best Strategy To Use For Home Appliances InsuranceThe Single Strategy To Use For Home Appliances InsuranceSome Known Details About Home Appliances Insurance Some Ideas on Home Appliances Insurance You Need To KnowHome Appliances Insurance - QuestionsThe Definitive Guide to Home Appliances Insurance

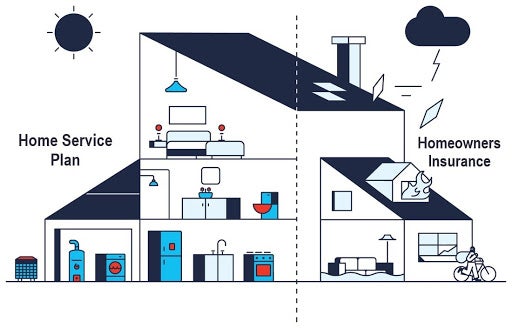

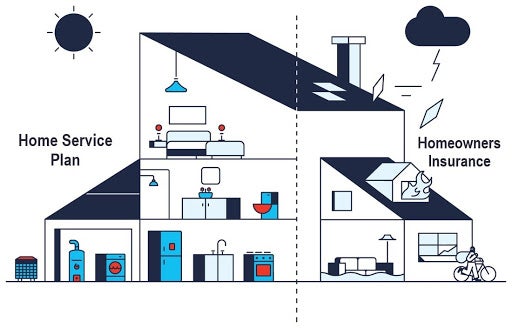

Accredited service warranty business have a Building and construction Professionals Board (CCB) certificate number. We can validate that number for you. Provide us with copies of correspondence or documents you obtain from the firm so we can help them abide by the legislation.Have you ever wondered what the distinction was in between a home guarantee and also home insurance? Do you require both a house warranty and also home insurance, or can you get simply one? A residence guarantee safeguards a residence's inner systems as well as home appliances.

Getting The Home Appliances Insurance To Work

If the system or appliance is covered under the homeowner's home service warranty plan, the home guarantee company will certainly send out a contractor who specializes in the fixing of that certain system or device. The house owner pays a flat price service call charge (usually in between $60-$100, depending on the home service warranty business) to have actually the professional pertained to their house and also diagnose the problem.

What does a residence service warranty cover? A home guarantee might additionally cover the larger appliances in a home like the dish washer, stove, refrigerator, clothes washer, and also clothes dryer.

Our Home Appliances Insurance Ideas

House insurance coverage might additionally cover clinical expenses for injuries that individuals suffered by getting on your residential or commercial property. A house owner pays a yearly costs to their home owner's insurance policy company. Typically, this is somewhere in between $300-$1,000 a year, depending on the policy. When something is harmed by a catastrophe that is covered under the house insurance plan, a property owner will certainly call their house insurance policy company to file a case.

Home owners will typically have to pay a deductible, a fixed quantity of money that appears of the home owner's pocketbook prior to the residence insurer pays any kind of cash in the direction of the insurance claim. A house see this insurance coverage deductible can be anywhere between $100 to $2,000. Usually, the greater the insurance deductible, the lower the annual premium expense.

What is the Distinction In Between House Guarantee and also Residence Insurance Coverage A residence guarantee contract as well as a home insurance plan run in similar ways. Both have a yearly costs and also a deductible, although a residence insurance coverage premium and also deductible is commonly much more than a home warranty's. The main distinctions between home warranties as well as home insurance coverage are what they cover (home appliances insurance).

A Biased View of Home Appliances Insurance

If there is damages done to the framework of your house, the proprietor won't have to pay the high expenses to repair it if they have residence insurance policy (home appliances insurance). If the damage to the house's structure or house owner's possessions was caused by a malfunctioning home appliances or systems, a residence service warranty can assist to cover the costly repair work or substitute if the system or home appliance has actually failed from regular damage.

They will certainly work with each other to provide security on pop over here every component of your residence. If you want acquiring a home service warranty for your home, take an appearance at Landmark's residence service warranty plans and prices here, or request a quote for your house below (home appliances insurance).

What Does Home Appliances Insurance Do?

"Nonetheless, the much more systems you add, such as swimming pool insurance coverage or an extra heater, the higher the price," she states. Adds Meenan: "Rates are typically flexible too." In addition to the annual charge, property owners can expect to pay usually $100 to $200 per solution call go to, depending on the sort of contract you get, Zwicker link notes.

"We paid $500 to join, and afterwards needed to pay an additional $300 to clean up the main sewer line after a shower drainpipe backup," states the Sanchezes. With $800 expense, they believed: "We really did not gain from the house service warranty whatsoever." As a young couple in another home, the Sanchezes had a hard experience with a home service warranty.

The Ultimate Guide To Home Appliances Insurance

When the service technician had not been pleased with a reading he obtained while examining the furnace, they state, the business would not accept coverage unless they paid to change a $400 component, which they did. While this was the Sanchezes experience years ago, Brown confirmed that "examining every significant device prior to supplying protection is not a sector standard."Constantly ask your carrier for clarity.